capital gains tax canada crypto

How Much Is Capital Gains Tax On Crypto. Taxable gains occur at a tax rate the same as regular income tax rates at 1087 to 1730.

Is Bitcoin Taxable In Canada Toronto Tax Lawyer

If you hold crypto for a period longer than 12 months and then opt to sell or trade that crypto you will be subject to a long-term capital.

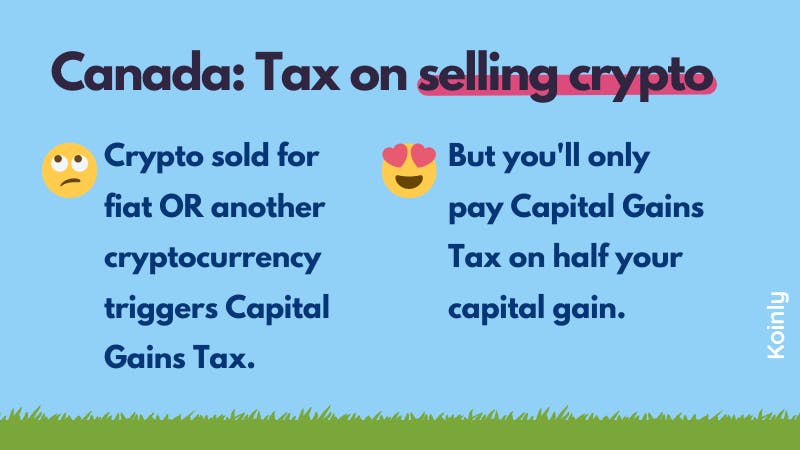

. So if anyone else has any experience with cryptocurrency taxes in Canada and what percentages youve been taxed at before or for 2021 id really appreciate the help. Cryptocurrencies are taking the financial world by storm and leaving a lot of Canadian investors confused about the correct way to report their crypto on their Canadian Tax returns. In Canada 50 of your realized capital gains are included as part of your taxable income and taxed at your marginal tax rate.

For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. In Canada the CRA expects all Crypto-Currency transactions to be treated in the same manner as any commodity would which means any increase in the price produces a Capital Gain taxable at 50 and any losses would create a Capital Loss. Remember you will only pay tax on your gains not your entire crypto investment.

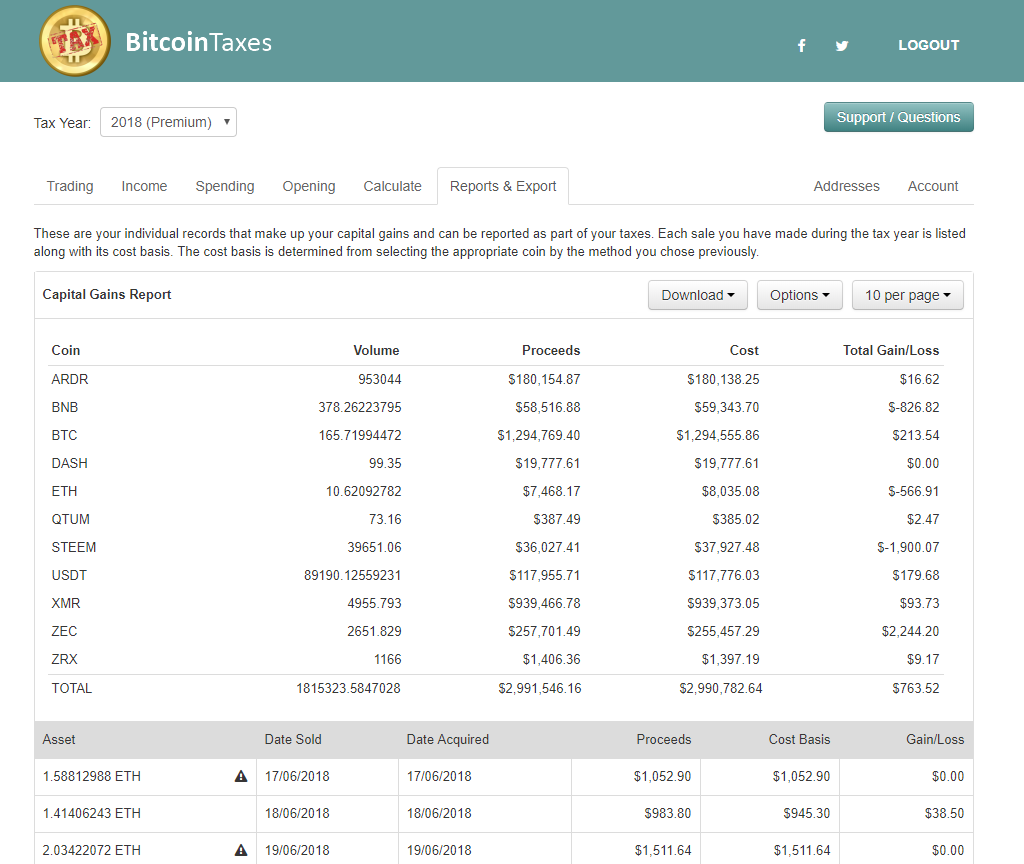

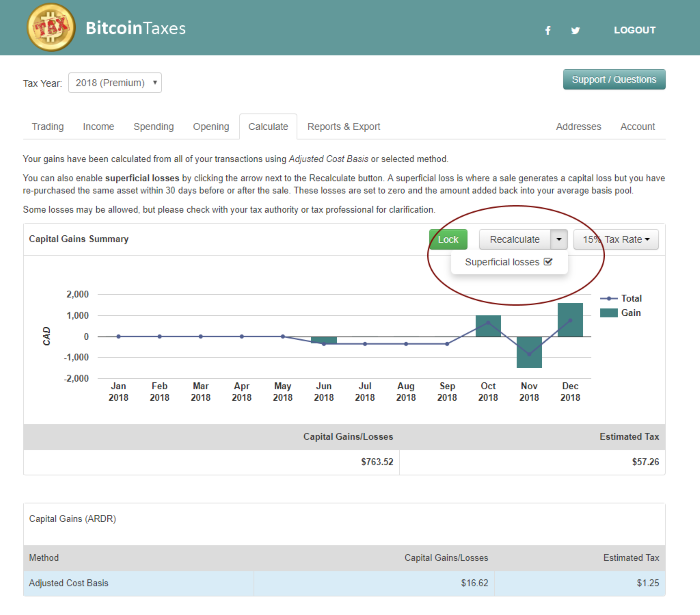

Capital gains tax report. In most jurisdictions capital gains taxes range between 10-40 for short term capital gains under a few years and 0-10 for long-term capital gains multiple year hold. Capital gains from the sale of cryptocurrency are generally included in income for the year but only half of the capital gain is subject to tax.

Say I put in 5000 in crypto and at market value now is 10000 then my net capital gains is 5000 if I sell it all. The short answer yes. This crypto tax software also includes a fully functional portfolio tracker which means you can track your overall gains or losses throughout the year.

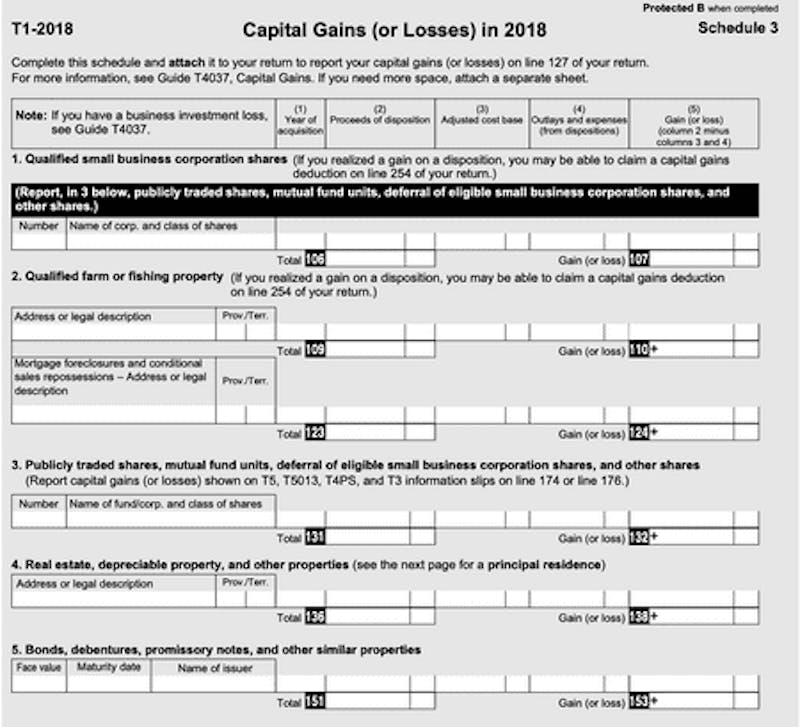

100 of business income is taxable while only 50 of income received from capital gains is taxable. If the sale of a cryptocurrency does not constitute carrying on a business and the amount it sells for is more than the original purchase price or its adjusted cost base then the taxpayer has realized a capital gain. Selling your crypto swapping it for another cryptocurrency gifting it or spending it on.

As another example suppose you sell that Ethereum for 4000 in Bitcoin and then use that 4000 of Bitcoin to buy a new car. How is crypto tax calculated in Canada. You dont need to pay any tax when you buy crypto but you will need to pay Capital Gains Tax when you make a capital gain profit from disposing of it.

The CRA treats cryptocurrencies as a commodity and not a currency and as such crypto is subject to capital gains tax read the CRA guide. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. Coinpanda generates ready-to-file forms based on.

However only half of your capital gains are taxed. Similarly if you incur losses these are treated as either business losses or capital losses for tax purposes. Crypto Capital Gains Tax Rate Canada.

The artists reputation grew over the years and you then sold that painting for 20000 in 2021 realizing a capital gain of 10000. For long-term capital gains tax purposes you are liable on short-term gains earned when your crypto becomes impure after holding for less than one year. In Canada these two different forms of incomebusiness income vs.

Capital gains on cryptos are taxed at the same rate as your federal and provincial income tax rates. Capital gainsare taxed differently. You will need to pay a tax on cryptocurrency gains within Canada.

You can even track your expected capital gains taxes over time rather than getting. Capital gains taxes decrease the longer you hold a crypto and could amount to 0 in some countries. The Canada Revenue Agency CRA treats cryptocurrency as a property taxed either as business income or capital gains.

Instead your crypto capital gains are taxed at the same rate as your Federal Income Tax rate and Provincial Income Tax rate. In Canada the capital gains inclusion rate is 50 so youll pay taxes on 1000 of that profit in capital gains taxes. Capital gains and taxes from crypto investment Hi people I have a few questions about investment in cryptocurrency and doing taxes for it.

Canada doesnt have a specific Capital Gains Tax rate and there is no short-term Capital Gains Tax rate or long-term Capital Gains Tax rate. If you buy crypto then sell it at a higher price than you bought it then that would count as a crypto capital gain. Establishing whether or not your transactions are part of a business is very important.

Yes the Canadian Revenue Agency CRA has issued official guidance stating that cryptocurrency is taxed as a capital gains asset which means you have to pay tax every time you trade sell or use crypto to pay for goodsitems. Capital gains tax rate. While 50 of capital gains are taxable 100 of business income is taxable.

This means that 50 of your gain is added to your income for the year and charged at your marginal rate. Note that only 50 of capital gains are taxable. There are no specific Capital Gains Tax rates in Canada and no short-term or long-term Capital Gains Tax rates.

For example lets say you purchased a painting for 10000 in 2013. Valuing cryptocurrency as inventory. The Canada Revenue Agency CRA has specified that cryptocurrency is a digital asset.

Canadian citizens have to report their capital gains from cryptocurrencies. Common confusion often arises from determining the need to pay business income tax or the aforementioned Capital Gains Tax. This 100 free-of-charge service enables users to quickly generate accurate and organised.

To muddy the waters further- US crypto tax. They taxed me on 50 of my earnings capital gains at a 2697 rate or roughly 135 on everything overall and im trying to figure out this have was normal or really high and what everyone is paying. Crypto Capital Gains Tax Rate Canada.

Canada Crypto Tax The Ultimate 2022 Guide Koinly

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

Crypto Taxation In Canada 2022 Ultimate Guide Ocryptocanada

Canadian Cryptocurrency Tax Reporting For Exchanges And Users Taxbit Blog

Canada Crypto Tax The Ultimate 2022 Guide Koinly

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

Declare Your Bitcoin Cryptocurrency Taxes In Canada Cra Koinly

Canada Crypto Tax The Ultimate 2022 Guide Koinly

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

.png)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canadian Cryptocurrency Tax Reporting For Exchanges And Users Taxbit Blog

How To Calculate Capital Gains On Cryptocurrency Sdg Accountant

Canadian Cryptocurrency Tax Reporting For Exchanges And Users Taxbit Blog